Technical analysis is a method or collection of techniques to study or analyze past data of financial assets such as stocks and currencies to forecast the future price movements or direction using statistics. It is also a subset of security analysis. It often shows contrast with fundamental analysis.

Unlike fundamental analysis, the technical analysis does not depend on company’s financial statements, management and business strategies. Instead, it follows statistics and mathematics. In technical analysis, “What is more important than Why”, According to The Modern Trader research, there are around 13.9 million traders in the world.

Components of Technical Analysis

Candlesticks

There a number of charts such as line and bar charts. Similarly, a candlestick chart is a chart which consist candlesticks, which show high, low, open and closing market prices of a financial asset such as stock, currency or derivative within a definite time interval.

Traders used to trade in market using candlestick charts mostly with compare to other charts, because it helps traders to visualize price movements in a better way.

Basic Chart Patterns

Markets show different types of chart patterns, where a pattern is a shape of market price charts of securities. There are various patterns such as double top, double bottom, triangles (ascending, descending and symmetrical), head & shoulders, rising & falling wedge, bullish & bearish pennant and rectangles. It is one of the basic components of financial technical analysis, which is used to know about the trend and sentiments of people, and it tell traders to which type of indicators, time interval and strategies have to use.

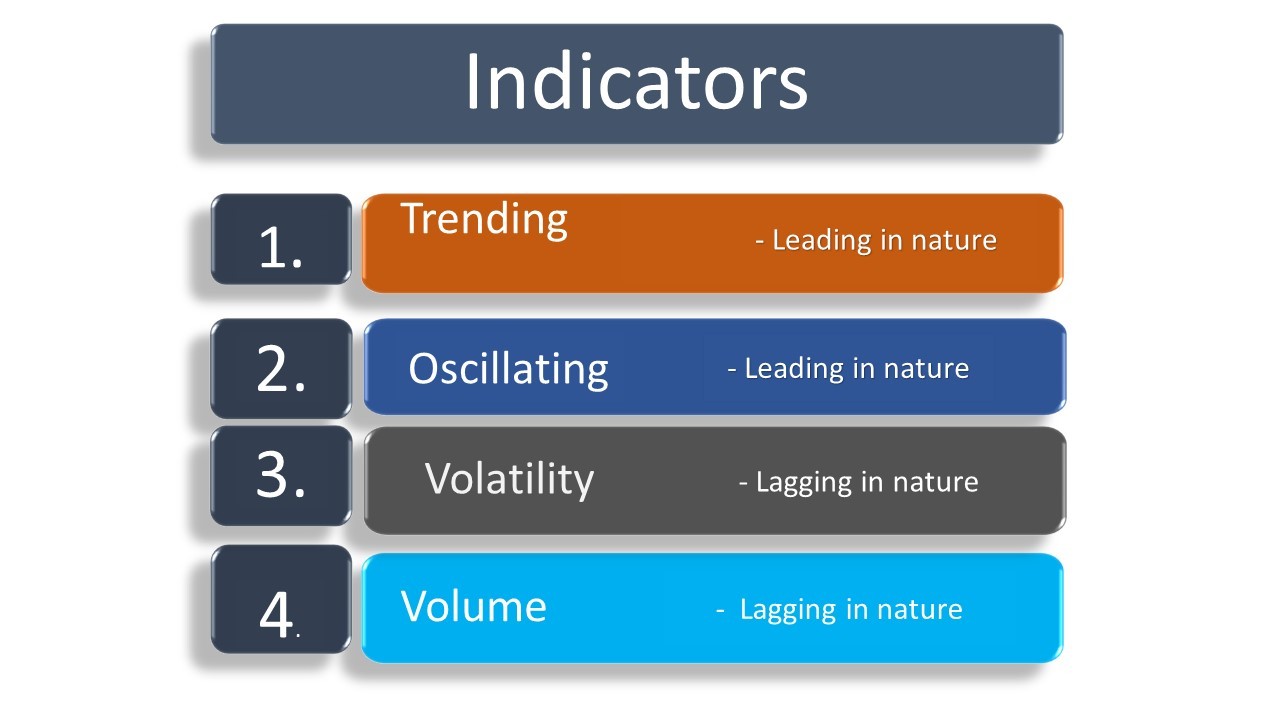

Indicators

Indicators play a great role to estimate the future target price or direction for a short time interval and analyzing price movements using past prices. It can be classified into two types, lagging and leading indicators. Leading indicators talks about the estimation of price movements of future. Lagging indicators tell traders about the strength of an existing trend.

On the basis of functions, there are four types of indicators

a. Trend Indicators

b. Momentum Indicators

c. Volatility Indicators

d. Volume Indicators

Chart Analysis

Chart analysis is a method which consist the techniques to analyze the market data of the financial security

Basic techniques to analyze a stock, commodity or currency chart are

1. Trend analysis

2. Support & Resistance

3. Applying appropriate indicators

4. Applying the same at different time frames (Time frames analysis)

Powered by Froala Editor