Introduction

There are two methods or respective, on the basis of which we can classify the types of stocks. Which are also trending in the finance world and its wizards.

Stocks on the basis of Characteristics

mainly there are two types of stocks the first one is common shares or equity shares in which a company offers its equity or ownership to the investors and on the other hand preferred shares issue to the investors.

But here we will do detailed discussion about each type of stock.

There are 4 types of stocks which are described below-

1.Equity Stocks

2.Preferred Stocks

3.Hybrid Stocks

4.Embedded-Derivative stocks

Equity Stocks

These types of stocks offer the company's equity or ownership to investors. In these equity stocks the investors get dividends from the firm but it can vary with the revenue generation of stock. these investors have rights to vote in company's decisions. Even if the company is getting liquidation then the equity investors are considered below than the preferred stock holders.

Note- a. Variation in dividends

b. Voting Rights

c. Last rank in line for liquidation

Preferred Stocks

These types of stocks promise to the investors that they will pay them fixed amount dividends every year. It will be independent of intrinsic value and revenue of the company. The stocks don't offer voting rights or ownership in the company. But these stockholders have right to get payments or assets first than anyone.

Note- a. Fixed dividends

b. No voting rights

c. Priority in liquidation

Hybrid Stocks

Some firms or companies also issue hybrid stocks. But we can say it as preferred stocks with an option to change their types of stocks into equity stocks or in simple way they are convertible preferred shares.

Note- a. Convertible preferred stocks

b. may/may not have rights

Embedded-Derivative Stocks

As we can see these stock come with the embedded derivative option. These options are of two types, the first one is call option where investors buy the stocks at a price and time. Similarly, the last one is put option in which the stockholders sell stocks to the company.

At a prescribed time or price.

Note- a. could be common or preferred

b. call-buy

c. put-sell

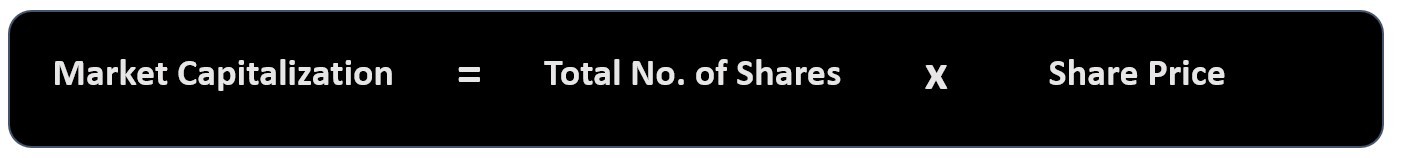

Stocks on the basis of market capitalization-

Stocks can also be classified on the basis of market capitalization. Now what is market capitalization of a company? market value of shareholdings a company and we can calculate it as product of total number of shares and price per share.

On the basis of market cap. types of stocks are:

1. Small -cap

2. Mid-cap

3. Large-cap

Small-cap

As the name suggest, these stocks are the smallest stocks with compare to other two. These stocks have small sizes. If we talk about INDIA the companies have less than INR 5000 crores comes into these stocks. Usually, these types of companies are new start-ups in the early stage of development. Small stocks are potentially big gainers as they have to expand the entity.

Being small enterprises, growth spurts dramatically affect their values and revenues, sending price souring. On the hand these stocks have more volatility and may decline too.

Mid-cap

Mid-cap are the stocks which have average market capitalization. The market capitalization of these stocks lies between INR5000 Cr- INR20000 Cr. These stocks are well recognized due to its past performances, these stocks offer us twin advantages of like because these category stocks contain growth as well as stability in the firm.

Mid-cap stocks also contain baby blue-chip companies, behave like large-cap companies but lack their size. These stocks have potential of the growth.

Large-cap

Large-cap are the largest market cap.

These stocks have market-cap. Above INR 20000 like ICICI bank, RELIANCE, HDFC BANK etc. and contribute in the country's economy too. These companies are listed in index of the stock markets like SENSEX and NIFTY. These types of companies are well grown and plays a big role of a country like development, employment, innovation etc.

These companies are listed in blue-chip companies and give better returns to the investors and usually these category entities contain low risk and high returns.

Powered by Froala Editor