What is trial balance?

Trial balance is the technique of checking the credit and debit balances are recorded in each ledger accounts and that too accurate. It is one of the important tools that reveal the final position of all the accounts. Further, it is used in the preparation of financial statements.

Now, the whole idea of preparing trial balance is that the accountant can draw the balances from the trial balance instead of looking and checking into each ledger accounts separately. Trial balance is generally prepared at the end of the accounting year. However, it can be prepared for half year or for the quarter period as well.

Let us understand the preparation of trial balance with the help of examples:

Trial balance example

Khan Pvt Ltd entered into the following transaction in the month of April 2021:

1. Khan Pvt Ltd started business with a capital of $. 8,00,000

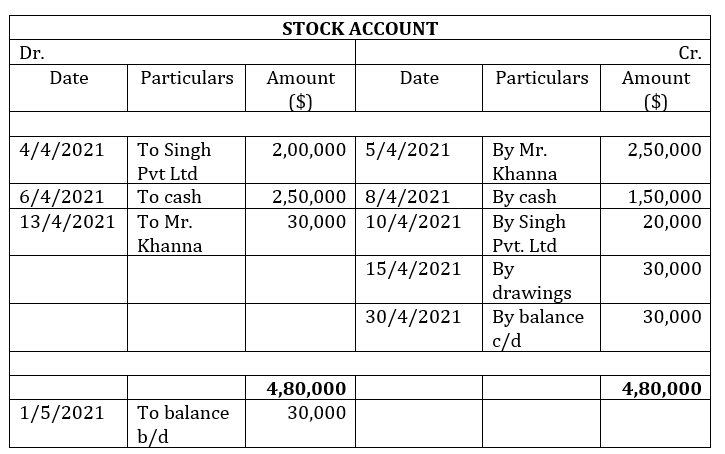

4. Bought goods from Singh Pvt. Ltd. on credit for $. 2,00,000

5. Sold goods to Mr. Khanna for $. 2,50,000

6. Cash purchases $ 2,50,000

8. Cash sales $ 1,50,000

10. Goods returned to Singh Pvt Ltd. $ 20,000

11. Purchased furniture for $ 1,50,000

12. Cash paid to Singh Pvt Ltd $ 1,20,000

13. Goods returned by Mr. Khanna $ 30,000

15. Goods taken by Khan Pvt Ltd for personal use $ 30,000

16. Cash received from Mr. Khanna of $ 1,20,000

17. Khan Pvt Ltd took loan from M/s Sahani $ 3,00,000

18. Salary paid $ 50,000

19. Purchased stationery for $ 10,000

20. Money paid to M/s Sahani for loan $ 1,80,000

21. Interest received $ 40,000

Steps in the preparation of trial balance

- Calculate the balance of each ledger accounts

- Record debit or credit balances in the trial balance

- Calculate the total of debit and credit column

- Make sure the total of debit and credits are equal.

Wrapping up

Trial balance is an important aspect of financial accounting as it is the first step in preparation of financial statements. In this article, we learned about the how to prepare trial balance with examples.

Powered by Froala Editor