After recording the daily financial transactions in the Journal Book, the second step is to post all these financial transactions into the respective ledger accounts.

What is a ledger?

A general accounting ledger is the collection of your chart of accounts where all the financial transactions are posted and end up for an accounting period.

Posting to an accounting ledger

Continuing the example of Bob where we practiced recording the journal entries for the first month of business. It is time to take those journal accounting entries and transfer the debits and credits to the appropriate accounts in the general ledger.

It is called as posting.

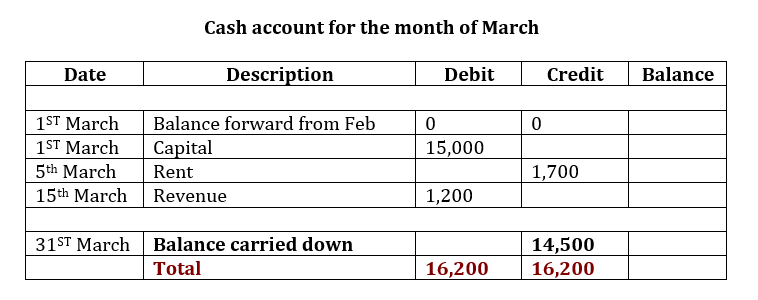

We have prepared the Cash Ledger that includes all the transactions of cash in the Journal book.

Summary of the example above:

- The first line is the balance that is carried forward from the previous month.

- The second line is the 1st March transaction where Bob deposited cash in the business. (Increased cash- debit)

- On the 5th March, Bob wrote cheques for $1,700 for the lease. (Decreased cash- credit).

- On the 15th March, the business had cash sales of $1,200. (Increased cash-debit)

Note that each type of account has either debit or credit balance depending upon the category of accounts.

- Asset account have debit balance

- Liability account have credit balance

- Owner’s equity has credit balance

- Income has a credit balance

- Expenses have a debit balance

Any transaction of similar nature is recorded in the subsidiary books. Let us understand the special books of entries in detail.

What are subsidiary books?

Subsidiary books are also known as the books of original entry. They are also known as daybook or special journals. These books are helpful in overcoming the limitations of journal book. Let us peek into some of the different types of Subsidiary books.

There is total 8 types of subsidiary books that are as follows:

- Cash book

- Purchase book

- Sales book

- Purchase return book

- Sales return book

- Bills receivable book

- Bills payable book

- Journal proper

#1 Cashbook

Cashbook records all the cash and bank receipts and payments. It is the book of original entry and records the transactions from the source documents such as invoices, vouchers, etc.

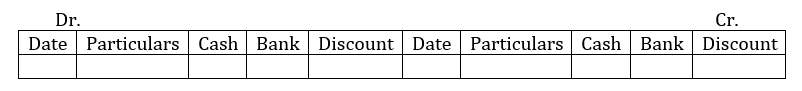

It is similar to a ledger account and acts as a subsidiary book. There are three types of cashbooks that is single column, double column, and triple column.

A single column cashbook has only cash column.

A double column cashbook has cash and bank column.

A triple column cashbook has cash, bank, and discount columns.

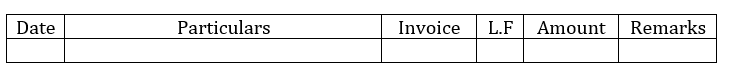

#2 Purchase book

A business records all the credit purchases in the Purchase book and records all the cash purchases in the cashbook. Record of assets purchased is not included in the Purchase book. They are recorded in the Journal proper.

#3 Sales book

A business records all credit sales of goods in the sales book. It records cash sales in the cashbook and assets sold are not recorded in the Sales book.

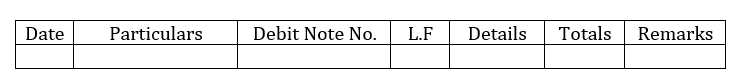

#4 Purchase return or return outward book

Every return of goods purchased is recorded in the purchase return book. A debit note is prepared for every return of goods.

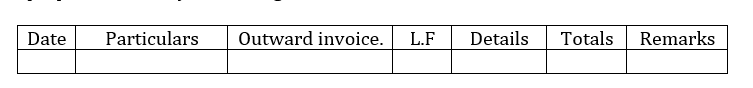

#5 Sales return book or return inward book

Every return of goods sold is recorded in the sales return book. A credit note is prepared for every return of goods.

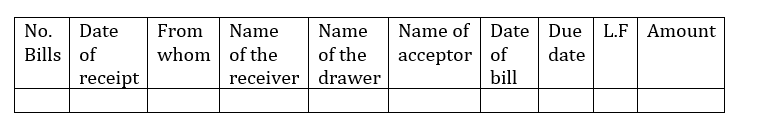

#6 Bills receivable book

All the acceptance of the bill is recorded in favour of bills receivable book. The total of bills receivable book is posted to the Bills receivable A/c and also need to post to the individual accounts of the customers.

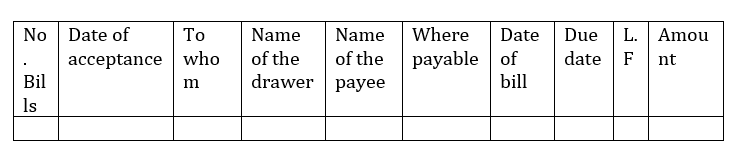

#7 Bills payable book

All the acceptance of the bills issued in favour of others is recorded in favour of bills payable book. The total of bills payable book is posted to the Bills payable A/c and also need to post to the individual accounts of the customers.

8# Journal Proper

It includes all the transactions related to the credit purchase and sale of assets, depreciation, and outstanding and pre-paid expenses.

Wrapping up

In this article, we learned how to post all the journal entries into their respective ledger accounts and also learned about different types of subsidiary books of accounts.

Powered by Froala Editor