Did you know there is a systematic process of recording financial transactions in the books of accounts? Yes, and that systematic process are known as bookkeeping. Just like a product going through various quality checks before getting packed, similarly the financial transactions have a systematic process before making the final financial statements. Let’s dive into the basics and overview of bookkeeping.

Overview of Bookkeeping

In a simple language, bookkeeping is the process of recording business financial transactions. Sounds fairly dimple, doesn’t it? There are certain bookkeeping basics one should know, as it is the first step of reaching the preparation of financial statements.

Bookkeeping basics- one should know

There are majorly five bookkeeping accounts one should know and understand:

- Assets: Anything that has a value in a business is considered as an asset. For example, inventory, computers, stock, etc.

- Liabilities: Any debts owned by the business are considered as liabilities. For example, loan, creditors, bills payable, etc.

- Revenue/Income: Revenue or income is the amount received by the business either through goods sold or services provided. For example, rent received, interest received, etc.

- Expenses: Expenses is the amount of money used or going out of the business. For example, rent paid, electricity expenses, salaries, etc.

- Equity: When you subtract liabilities from the assets of the business, you will get equity that reflects the financial interest in the business.

Normally, every business owner follows the double entry bookkeeping system that is highly recommended. Here, in this system, each transaction has two-fold effects, which is debit and credit. Every debit has a corresponding credit and vice versa.

Knowing about the bookkeeping basics will lead to the very first step of recording financial transactions. The financial transactions are first recorded in the Journal Book.

What is a Journal Entry?

A journal entry is the primary recording book of all the day-to-day financial transactions. Before the invention of computerized accounts, the process of recording transactions was manual.

What is in a Journal Entry?

A journey entry should include the following:

- Unique identifying number

- Date of transaction

- Amount to be credited and debited

- Account where the debits and credits are recorded

- Name of the person making an entry

- Whether the transaction is one time or recurring

- A description of the transaction also known as narration.

The best way to learn something is to do it. Let us study some examples of general journal entries to have a clear idea on the concept.

Examples of Journal Entries

#1 Bob opened a new merchandise-clothing store by investing $15,000 into their new business on 1st March.

#2 On 5TH March, the company paid their first month’s rent of $1,700.

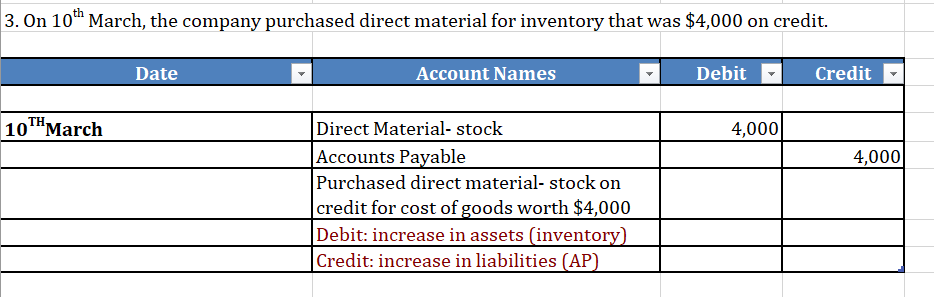

#3 On 10th March, the company purchased direct material for inventory that was $4,000 on credit.

#4 On 15TH March, the company made sales of $2,000 and received $1,200 in cash and remaining $1,000 as Accounts receivable.

#5 Also, on March 15th, an expense was made to purchase materials that will be used to create inventory for $ 600.

These were some of the examples of Journal Entries. Notice how each transaction is balanced. Everything entered on the debit side has a credit effect as well. This is how double entry bookkeeping system works.

After recording the daily financial transactions in the Journal Book, the second step is to post all these financial transactions into the respective ledger accounts.

Wrapping up

So, we learned the process of recording financial transactions in the journal and with the help of examples. In this next article we will learn about the next step that is to post these transactions to the ledger along the format of different subsidiary books of accounts.

Powered by Froala Editor