Imagine if you have opened your own boutique business and the business is working really well. There have been a lot of sales and purchase transactions from various customers and clients. At the end of the year, you want to find out how much profit or loss did the business made? How will you find? What is the procedure of finding or concluding that the business made profits or losses in a particular year?

Well, here comes the role of accounting.

What is accounting?

Accounting means a process of recording all the financial transactions pertaining to the business. It is the process of summarizing, recording, analyzing, and reporting the financial business transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in the accounting provides an essential summary of financial transactions of a business over the accounting period, summarizes company’s operations, financial position, and cash flows.

Did you know from where the accounting process and recording transactions started? Let’s rewind and go back to the ancient civilization years and know more about the history of accounting.

History of Accounting

The history of accounting is as long as the evolution of money. Accounting history dates back to the ancient civilizations of Egypt, Mesopotamia, and Babylon. The Roman Empire government has to provide detailed records of the finances.

Luca Pacioli is regarded as the “Father of Book-keeping” because of his book publication based on the double entry book-keeping system in the year 1494.

The accounting profession was fully recognized by the year 1880 with the formation of Institute of Chartered Accountants in England and Wales. The accounting profession was highly famous during the Industrial Revolution where merchants need not to only record the transactions but also sought to avoid bankruptcy as well.

At present, there are many professional courses associated in the field of accountancy. We also celebrate World Accountants Day.

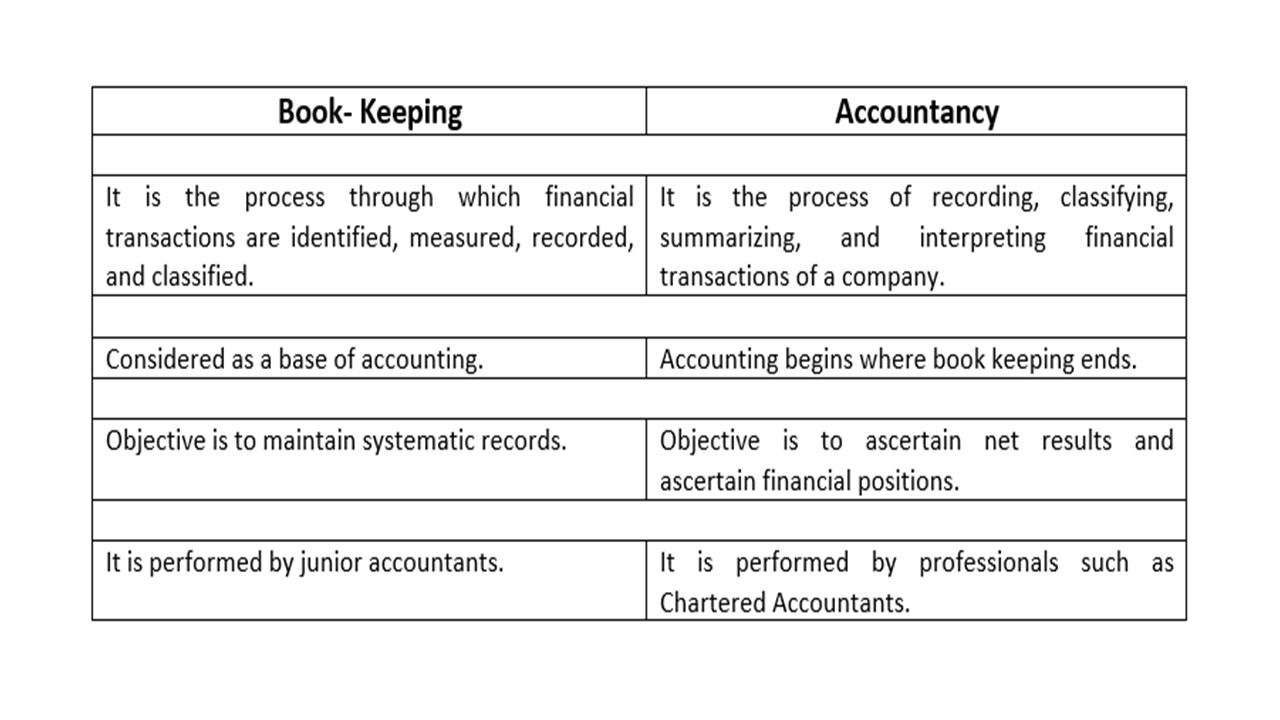

One often gets confused between the two terms which is book-keeping and accounting. Book-keeping and accounting may overlap in many ways. However, both are very different in their own respective terms. Let us know more about the distinction between bookkeeping and Accountancy.

Book-keeping v/s Accounting:

Why Accounting is essential for your business?

Every great journey begins with a roadmap. What are your business goals? What will be your company’s profit look like five years from now? All these questions have only one answer: Accounting is essential for analyzing your company’s financial performance. Apart from these various other reasons are:

To register your company is the first step after opening your business or a company. There you will come across the term books of accounts. Now what are the books of accounts? What are different sets and methods of maintaining books of accounts? Is it necessary to keep updated the books of accounts? Let’s know more in this section:

Books of Accounts

Books of accounts are the set of books wherein all the accounting and financial transactions pertaining to the business are recorded. Every company has to compulsory maintain the books of accounts in order to avoid penalties from higher authorities.

3 Formats of Books of Accounts

There are three formats of books of accounts which are as follows:

1. Manual Accounts:

Manual accounts are the traditional method of recording financial transactions hand written. The transactions are recorded in the books which are easily available in stores. It is mostly used by small businesses and sole proprietors.

2. Loose- leaf Accounts:

In this method, recording is done using the spread sheets like Microsoft Excel. Many companies use Quick books for their book keeping and accounting transactions and export the annual reports to the Excel.

3. Computerized Books of Accounts:

This method is mostly used by big companies where accounting software is used such as Tally or SAP. Invoices and receipts are automatically generated which are usually computerized.

3 things to remember regarding the books of accounts:

1. Register your books of accounts.

2. Update your books of accounts regularly to avoid tax penalties.

3. Keep the books of accounts at the registered place of your company.

Types of Accounting

Broadly speaking, there are three branches of accounting which are as follows

1. Financial Accounting:

Includes bookkeeping, preparation, and analysis of Financial Statements.

2. Management Accounting:

A system to assemble and furnish the useful material and summarized accounting information to the management.

3. Cost Accounting:

Deals with the cost of production and its various constituents.

Wrapping up

We have already seen about the meaning of accounting and its brief history along with the various branches of accounts After knowing the fundamentals, one can proceed with the understanding and preparation of financial statements.

Powered by Froala Editor