Introduction

Having opened a business comes with lots of responsibilities. One aspect of responsibility is attached with regards to bookkeeping and accountancy of the business. Financial accounting is one such branch of accounting.

Financial Accounting is the process of preparing financial statements that companies use to show their financial performance and position of the company to the people outside the company, to the investors, creditors, suppliers, and customers.

Now, the question arises how do professionals prepare the financial statements? Well, the very first step of preparing the financial statements is to record all the transactions of the business and follow the accounting cycle.

What do you mean by Accounting Cycle? What is the process of following the accounting cycle?

Accounting Cycle

Accounting cycle is the collective process of recording, analyzing, classifying all the financial transactions of the company. The standard eight-step process cycle starts when a business transaction occurs.

As we all have mathematical rules to perform mathematical calculations, we also have methodical set of rules to ensure about the conformity and accuracy of the financial statements. With the advent of computerized accounting software, the accounting cycles have helped to reduce mathematical and calculation errors.

Let us look at the 8 steps of accounting cycle:

1. Identify transaction: The first step is to identify various accounting transactions of the business and bifurcate it into sales, purchase, refund, payment transactions and so on.

2. Record transaction: After identifying the transactions, the next step is to record the sales, purchase, payments, refund, and other bifurcated transactions into Journal. Journal is the book of primary entry of business transactions in bookkeeping.

3. Posting: Once the transactions are recorded as Journal Entries, the next step is to post the entries in General Ledger. It provides the breakdown of all accounting activities.

4. Unadjusted trial balance: After recording the transactions in Journal and posting it to the General Ledger, prepare unadjusted trial balance. It is used to ensure that all the debits are equal to all the credits.

5. Worksheet: Worksheet is the final step to ensure debits are equal to credits. If any discrepancies is found the said adjustments are to be made.

6. Adjusting journal Entries: With respect to any discrepancies founded in the worksheet and changes made accordingly, the adjusting Journal entries are made.

7. Financial Statements: After posting the adjusted entries, a company prepares an adjusted trial balance and prepares the formalized financial statements.

8. Closing the books: After preparing the financial statements, an entity finalizes temporary accounts, revenues, and expenses, at the end of the period using closing entries.

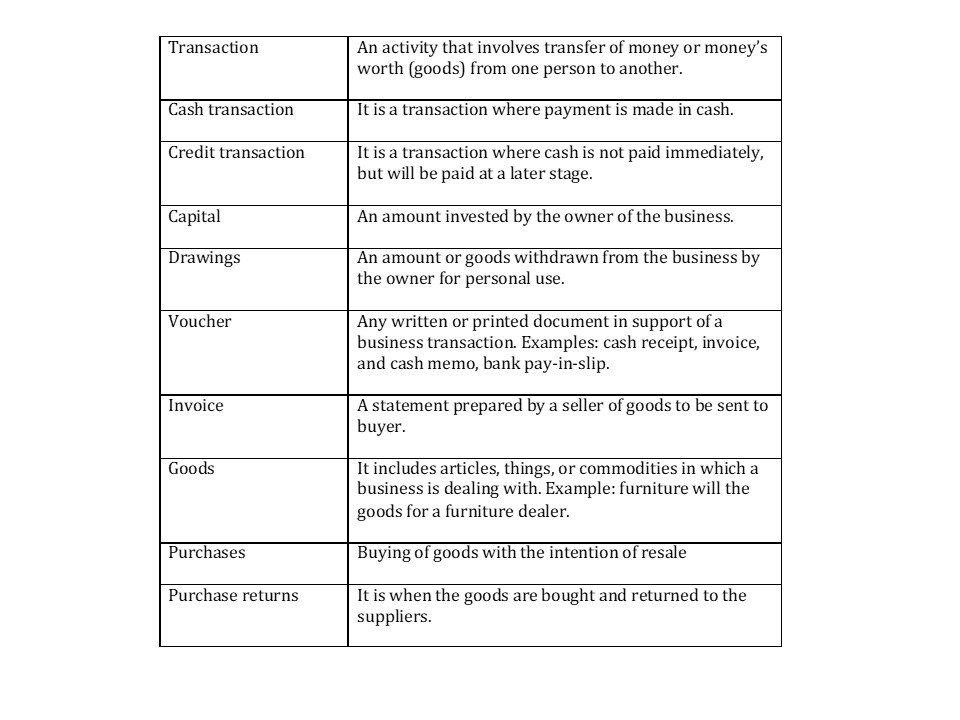

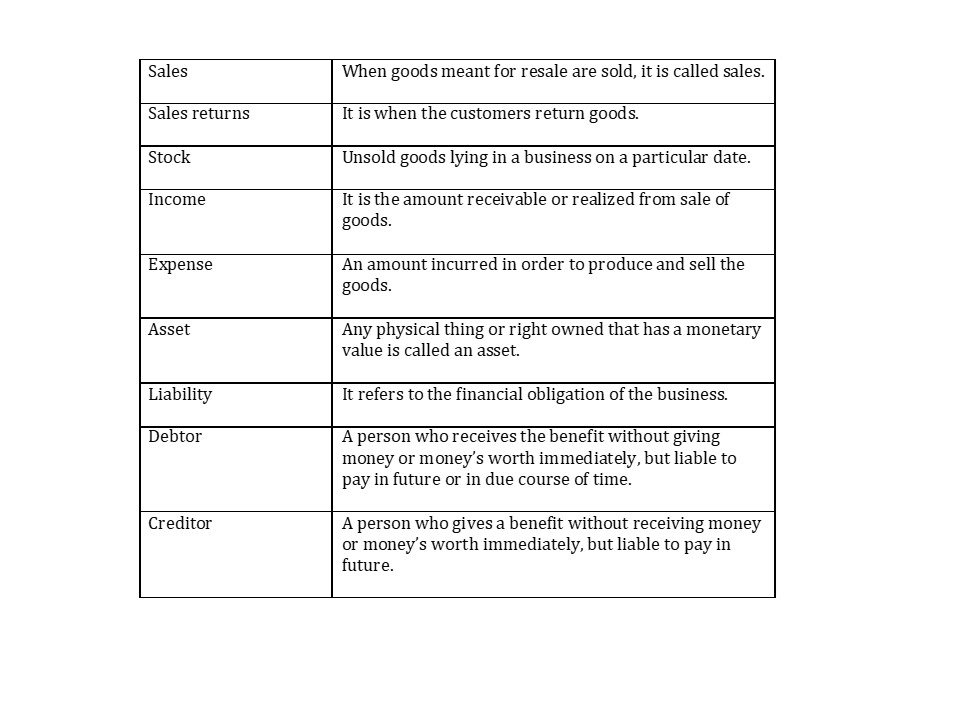

Accounting has its own dictionary. It is a versatile system serving large number of purposes in the modern business world. Thus, every business owner and a layman must also understand the basic accounting terminologies.

Basic Accounting Terms

Wrapping up

Accounting is a very vast concept. We have already learned the basic accounting terminologies that will help all the financial accounting learners to understand the core concept perfectly.

Powered by Froala Editor